Access Alternatives, LLC sources and structures alternative investment opportunities.

As a complement to Access Investment Management, Access Alternatives focuses on alternative investment allocations that can help diversify portfolios and enhance overall returns.1 These investments include: real estate; private equity; growth capital; alternative fixed income; and alternative public strategies. Nic Lancelotta has 10+ years of experience sourcing, structuring and managing alternative investments.

Years of alternative

investment experience

Invested capital 2

While there is no universally accepted definition for “alternatives,” these investments are broadly defined as investments that do not fall into one of the more conventional categories of equities, bonds, and cash.3

Private Alternatives

- Private equity

- Real estate

- Private credit

- Structured products

Public Alternatives

- Sector funds

- Concentrated funds

- Hedge funds

- Other

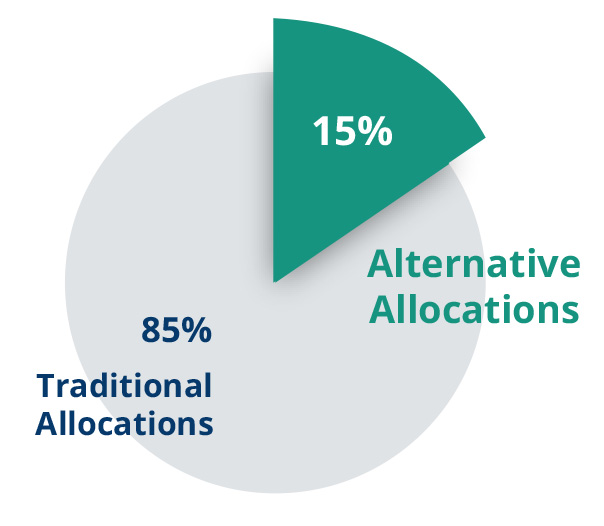

Exhibit 1

Even though alternatives are more common allocations for larger investors (family offices, endowments, and ultra high-net-worth), individual accredited and/or qualified investors can legally participate (pursuant to Regulation D of the Securities Act) and there are compelling reasons to consider these investments.4

Diversification

A distinguishing feature of most alternative investments is their lack of correlation with the more traditional asset classes (public equities and public fixed income).5 Because public market correlations have markedly increased in recent years, a portfolio containing a variety of alternative assets can offer investors reduced risk without a proportionate reduction in expected return.6

Enhanced Returns

Alternative investments often have structural features (transaction scarcity / unpredictable pricing / informational opacity / heterogeneity) that can create inefficiencies in the market.7 There is a wealth of empirical evidence that shows that (for the same or similar exposure set) these inefficiencies can offer investors superior risk-adjusted returns.8 In fact, institutions with larger alternative allocations have been shown to outperform peers with less exposure.9

Exhibit 2

Consistent with ACM’s value approach, the starting point for any prospective Access Alternatives investment is a careful assessment of downside risk.

Access Alternatives avoids turn arounds, brokered transactions, and early-stage investments. Access Alternatives is also particularly focused on structural protections that mitigate and/or compartmentalize investor risk. While one-off direct investments are considered, sourcing is typically centered on established sponsors and trusted investment partners.

Among other factors, the manager places heavy emphasis on the following considerations and characteristics: management and/or sponsor track record; management and/or sponsor investment level and placement in the waterfall; leverage ratios and flexibility of the overall capital structure; shareholder friendly terms (blocks / supermajority provisions); the ability for shareholders and Access Alternatives to have a voice (board seat, advisory, or management); capital intensity; and cyclicality. Access Alternatives also relies on its partners, advisors, and industry contacts to review potential opportunities.

Importantly, Mr. Lancelotta personally invests in every Access Alternatives investment.

Access Alternatives targets investments that have the following attributes:

Net pre-tax return

Preferred investment

duration (years)

Minimum investment

Nic Lancelotta

Investor with 20 years of institutional and alternative investment experience.

After practicing law as a business litigator in Maryland and the District of Columbia, Nic Lancelotta started his 20-year career on Wall Street as a Vice President for First Union Securities in 1999. Mr. Lancelotta joined CIBC as a Director in 2002, and in 2003 he opened the institutional equity capital markets office for Legg Mason (NYSE: LM) in Atlanta, Georgia. Under Nic’s leadership, this office (now Stifel — NYSE: SF) was consistently ranked a market share leader in the Southeast. Over the past 20 years, and as one of six regional managing directors, Mr. Lancelotta developed an extensive network that includes some of the largest and most successful public and private investors in the region.

In 2010, Mr. Lancelotta formed an investment partnership (Spearpoint, LLC) to invest in private and public alternatives. In 2012, Mr. Lancelotta co-founded an alternatives-focused partnership (L and R Investors, LLC). Access Alternatives, LLC (formerly Access Capital Management, LLC) was formed in 2020 to manage and facilitate similar investment partnerships.

Over the past 10 years, Mr. Lancelotta has sourced, structured, managed and personally invested in 35+ alternative investments (including real estate, private equity, growth capital, and public and private funds). The associated investment vehicles have invested over $75 Million in capital. 10 Mr. Lancelotta has also held advisory and management roles in several of the underlying investments. 11

Mr. Lancelotta is licensed to practice law in Maryland and the District of Columbia and holds his Series 7, 9, and 10 securities licenses.12 Nic has a BBA from James Madison University and a JD from the University of Baltimore (Honors).

Access Alternatives Team

Nic Lancelotta

Nic Lancelotta was a Regional Managing Director for Stifel’s Institutional Capital Markets Division (NYSE: SF). In this role, Nic spent 17 years working closely with some of the largest investment managers in the US. After 10+ years of investing in alternatives, Mr. Lancelotta founded what is now Access Alternatives, LLC. Access Alternatives specializes in non-public / alternative investments and, since inception, has invested over $75M in capital.13

Jenn Phillips

Jennifer Phillips began her career in the financial industry at A.G. Edwards and Sons in 1998. Jennifer held client service roles in both the retail and institutional brokerage capacity. In 2001, she joined the A.G. Edwards Institutional Equity Sales Team and was responsible for covering the Southeast. Jenn has a BBA from Southern Methodist University in Dallas, Texas. She lives with her family in Atlanta, Georgia.

Access Alternatives, LLC – Board of Advisors 14

Mike Masters

Mike Masters founded Masters Capital Management in 1994 with a vision for an investment company that would align with his professional and personal values.

Michael W. Roher

Mr. Roher serves as a Senior Partner of BlueArc Capital Partners, the firm’s private equity group, as well as BlueArc Mezzanine Partners, the firm’s mezzanine lending strategy.

Mike Bradley

Mike Bradley is the President of MacKenzie Investment Group, LLC (“MIG”). Mike is also a principal and board member of Mackenzie Ventures, LLC, the holding company for the MacKenzie Companies ("MacKenzie").

Rick Van Nostrand

Rick Van Nostrand serves as a Senior Portfolio Manager, Board Member and Partner at Cornerstone Investment Partners, where he focuses on using a value discipline to identify mispriced equities.

Randy Loving

Randy is a Senior Portfolio Manager at Montag, a registered investment advisor in Atlanta with assets of $1.8 Billion under management.

Douglas L. Rieder

Douglas L. Rieder is Executive Chairman & Client Advisor at Sterling Seacrest Pritchard and has over 30 years of experience in the insurance and surety business.

Access Alternatives and Access Investment Management work together to provide clients with comprehensive and coordinated wealth management solutions.1

While Access Alternatives focuses on alternative allocations, Access Investment Management is an active manager of traditional / publicly traded investments.

1 Access Capital Management, LLC is a Georgia Limited Liability Company. It may be referred to in this website as “Access Capital” or “ACM”. No securities are offered through this website or by Access Capital Management, LLC, Access Alternatives, LLC, Access Investment Management, LLC or any other entity. Access Alternatives, LLC and Access Investment Management, LLC are separately owned and operated. Access Investment Management, LLC is a Securities and Exchange Commission Registered Investment Advisor. Any securities offered by these ACM affiliates would be via a client agreement (in the case of Access Investment Management, LLC) or via subscription documents (in the case of Access Alternatives, LLC).

2 $75M includes affiliate investment vehicles since inception and is not the amount currently under management by Access Alternatives, LLC.

3 Carlson, Debbie. A Beginner’s Guide to Alternative Investments – Investing 101. US News (2020): page 2.

4 Seeking an Alternative: Understanding and Allocating to Alternative Investments. Blackstone Alts Lab (2018): pp. 9-12; Guinney, Mark D. and Adam Kobor. Asset Allocation to Alternative Investments. CFA Institute (2019): pp. 2-25.

5 Black, Keith H., Donald R. Chambers and Nelson J. Lacey. Alternative Investments: A Primer for Investment Professionals. CFA Institute Research Foundation (2018): page 10.

6 Seeking an Alternative: Understanding and Allocating to Alternative Investments. Blackstone Alts Lab (2018): page 10; Why Private Markets Outperform Traditional Publicly-Traded Stocks and Bonds. Fundrise (2020): pp. 5-10.

Source: Exhibit 1: While there is no rule for alternative exposure, many firms recommend an allocation of between 10-20%. Davis, Walter. The basics of alternative investments – Part 4: How to incorporate alternatives into your portfolio. Invesco Ltd. (2018); Mercado, Darla. Here’s how much financial advisors should invest in alternatives to make a difference. CNBC – FA Playbook (2019).

Source: Exhibit 2: Markowitz, Harry – The Markowitz Efficient Frontier Chart; Lee, Sang H. 4 Reasons Why Investors Should Consider Alternative Investments. The Street (2015).

7 Why Private Markets Outperform Traditional Publicly-Traded Stocks and Bonds. Fundrise (2020): pp. 2-8.

8 The 15% Frontier. Cambridge Associates (2016); Black, Keith H., Donald R. Chambers and Nelson J. Lacey. Alternative Investments: A Primer for Investment Professionals. CFA Institute Research Foundation (2018): page 10; Seeking an Alternative: Understanding and Allocating to Alternative Investments. Blackstone Alts Lab (2018): page 10; Dyck, Alexander and Lukasz Pomorski. Investor Scale and Performance in Private Equity Investments. Review of Finance (2016) pp. 1081-106; Guinney, Mark D. and Adam Kobor. Asset Allocation to Alternative Investments. CFA Institute (2019): pp. 2-10.

9 Private Investing for Private Investors: Life can be better after 40 (%). Cambridge Associates (2019); Why Private Markets Outperform Traditional Publicly-Traded Stocks and Bonds. Fundrise (2020): page 6.

10 $75M includes affiliate investment vehicles since inception and is not the amount currently under management by Access Alternatives, LLC.

11 Referenced investment vehicles include Lancelotta affiliate companies.

12 Noted licensure is up to date and active. Mr. Lancelotta is not currently registered with a broker/dealer. See https://brokercheck.finra.org/.

13 $75M includes affiliate investment vehicles since inception and is not the amount currently under management by Access Alternatives, LLC.

14 The advisors shown have no formal relationship with ACM or Access Alternatives, LLC. They are not compensated in any way by ACM or any affiliate. One or more of them may be used as a resource by Access Alternatives, LLC in its consideration of possible investments. Conflicts of interests may exist relating to an advisor and an investment. In addition to these advisors, Access Alternatives, LLC uses other sources of information in its due diligence process. The listed advisors have no ownership interest in ACM or Access Alternatives, LLC and they are not endorsing any information on this website.